This summer saw a marked shift among US investors and policymakers.

Investors, fearing economic resilience would keep monetary policy tight, saw good new as bad. And by mid-October, the bond market rout that began in Q3 had pushed long-term interest rates to 15-year highs. But while markets became gloomy, the opposite was true for those monitoring economic developments. Hopes of a soft landing grew as the US economy outperformed and inflation held its summer gains.

Macro and market trends have not shifted significantly in October, despite geopolitical turmoil and disarray on Capitol Hill. The relative calm will only continue if the conflict in the Middle East

stays contained, without spillover to energy markets or trade more generally. Washington political dysfunction also complicates international relations. Before the attack on Israel on October 7, President Biden was forced to reassure key counterparts of America’s leadership role when aid to Ukraine was denied in the short-term funding bill passed on September 30. That came just before Congress essentially shut down, with the ousting of House Speaker Kevin McCarthy. Two Republican nominees for Speaker have since failed to win the necessary votes to win. One glimmer of hope is that the resistance to the second nominee, Jim Jordan, came from more traditional Republicans who rejected Jordan’s previous scorched earth attitude to legislating and his willingness to see the government shut down or be unable to pay it.

Hopes of avoiding recession while restoring price stability were challenged late in the quarter by two new headwinds facing the economy. Rising energy costs, as Saudi Arabia and Russia joined in announcing production cuts, threatened to undercut progress on inflation and a strike by United Auto Workers (UAW) that extended into its second week by end-September risked economic recovery, with an estimated cost to the economy of some $100-$125 million every week it continues, according to estimates from Goldman Sachs. The strike has moved off the front page. But it continues, with attendant costs to the auto industry and the economy more broadly.

RockCreek seeks three macro themes for the final quarter of 2023:

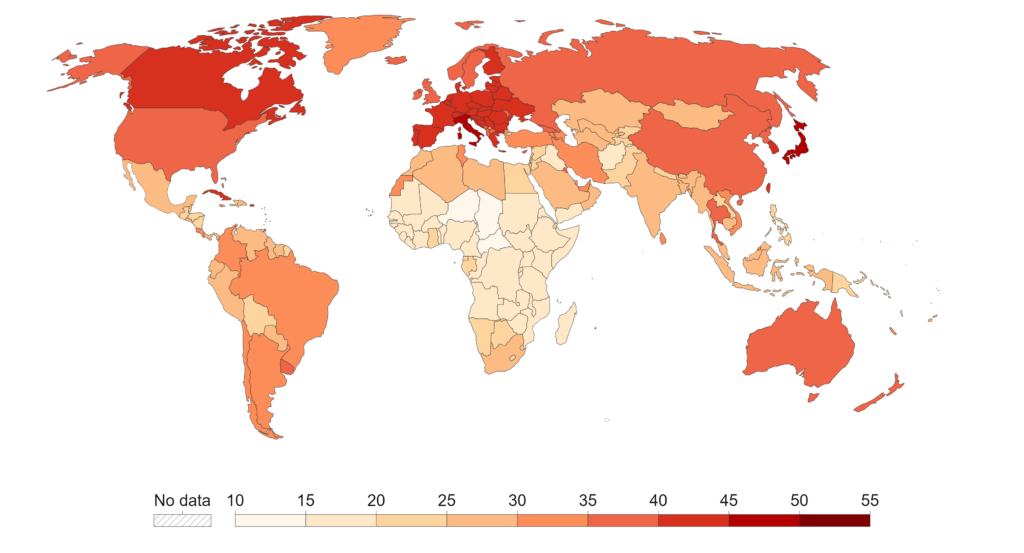

Slowing global economy: Have we seen the full impact of the global cycle of monetary tightening or is there more to come, for example, through a decline in bank lending in Europe and the US, real estate problems – notably in China – or weakening global trade?

US Outlook: Unlike in Europe, where the economy has stagnated as the ECB fights inflation, the American economy has remained resilient. With headwinds from rising oil prices and the autoworkers’ strike, as well as tight money, is a soft landing still in the cards?

Higher for longer: Will markets and the global economy adjust smoothly to a likely “new” new normal of “higher for longer” interest rates, held up in part by rising fiscal debt and deficits in the US and elsewhere? Developments in US bond markets in recent weeks may herald a regime change. As government deficits grown, the demand for Treasuries is also slowing with QT replacing QE and traditional buyers such as Japan changing policies.

Read the full RockCreek Q3 2023 Commentary Letter

Sections

Macro Environment

Sustainable Investing

Public Equities

Emerging Markets

Fixed Income

Public Credit

Private Credit

Private Equity & Venture Capital

Real Estate