Alberto Fassinotti, Managing Director

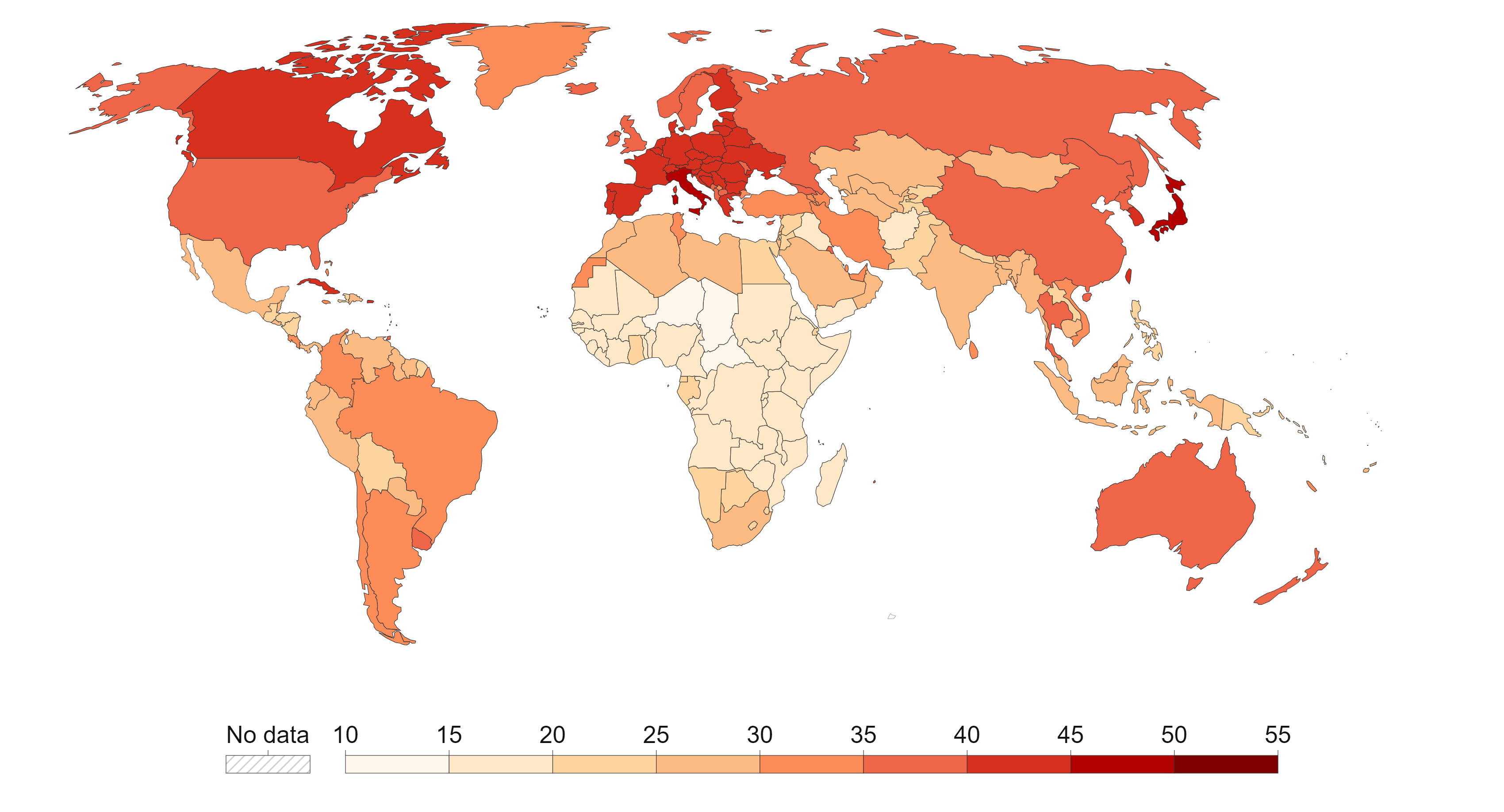

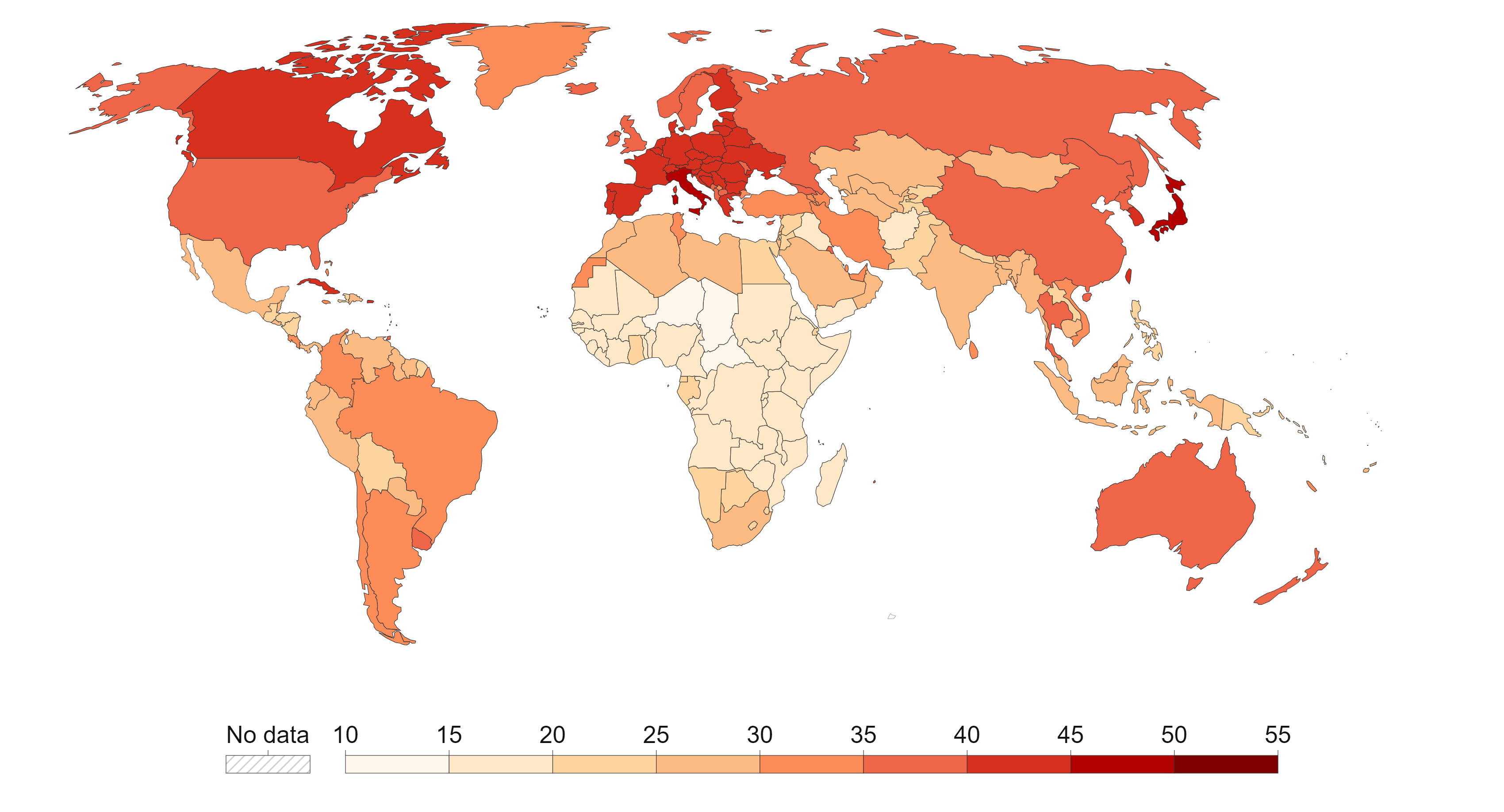

Although a frequent traveler to India, every visit surprises me. The number of people milling around is overwhelming. To put that in perspective, nearly every sixth person in the world is an Indian living in an area a third the size of the US. They are also young – with a median age of 28 years. For comparison, western countries’ median age is 40 years, while Japan is nearly 50 years.

Median Age by Country, 2021

Source: United Nations, World Population Prospects 2022

Given their age, it is not surprising that Indians, on average, are optimistic. Recent surveys show that 80% of Indians believe the country is moving in the right direction, compared to 30% for the US. For most Indians, Covid is a distant memory; no more ‘working from home.’ While it is not surprising to see roads clogged with office goers, it is surprising to see so many on electric scooters. Many cars on the road are EVs. Gone are the days of the trusted bicycle. Also surprising is their gender mix. More and more women are joining the workforce – a change brought about by lower fertility rates and better access to education, health, and childcare. This improvement in the gender mix, however, is tilted towards the southern states, in large part because they are socially more progressive than their northern brethren. All this has resulted in the per capita income of the south being three times that of the north, a divergence reached over the last 30 years. Besides changes in the social dimension, one cannot avoid being struck by significant changes in the physical environment. There is significant infrastructure activity – more roads, subways, ports, and airports. And finally, one sees better digital connectivity, with one in two Indians having a cell phone and access to the internet at costs that put US carriers to shame.

Macro Environment

Shifting gears to the macro environment, the crowded stores and bazaars are a reminder that India is a consumption-driven growth model, unlike China, whose growth is investment driven. In India, consumption accounts for 60% of GDP growth. Covid depleted household savings, and the rebuilding of consumer balance sheets is still ongoing. Government finances are stretched, and its ability to spur GDP growth by additional investment is limited. Consequently, the onus for growth rests on private capital investments. While private companies have strong balance sheets, their capital investments remain muted. On the plus side, the banking sector is coming off of five years of concerted efforts to clean up non-performing loans and is in a strong position to catalyze new credit growth. Realizing a GDP growth above 6% may be a stretch over the next year or two; however, 6% will make India one of the fastest growing economies and enable it to grow from a $3 trillion to $6 trillion economy by end of the decade – making it the world’s third largest economy behind the US and China.

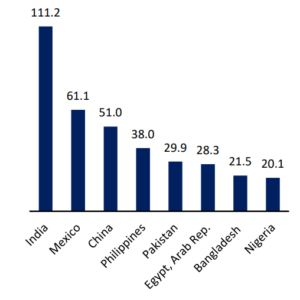

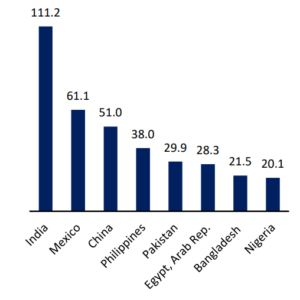

Inflation is high and the country faces a mixed monsoon in 2023. A visit to the local supermarket confirms higher prices of food staples like rice and tomatoes – hence the recent ban on rice exports. Energy prices, especially for electricity, are also higher. The blame here is attributed to the costs of funding the energy transition. In this environment, the leeway for the Indian central bank to cut rates is, unlike peers in Brazil and Chile, limited (even if the US Fed rate hikes come to an end). The current account deficit at 2% of GDP is manageable and easily covered by invisibles, including services and remittances. Inward remittances from overseas Indians have been trending up, and at $100 billion per year – the largest for any country – have helped India manage spikes in oil prices. With significant FX reserves of more than $600 billion and higher interest rates, the Indian rupee will perhaps remain stable over the next 12 to 18 months.

Top Recipients of Remittances Among Low- and Middle-Income Countries (2022)

Source: World Bank – KNOMAD staff

Bottom Line

What does all this mean for investors looking at Indian equities? Over the past 10 years, Indian equities have generated a 185% return compared to 0% for EM equities. Equity multiples at 19x are slightly above their historic averages. Corporate earnings that were affected by Covid are slightly above average, as indeed is their return on equity at 15+%. With strong flows from domestic and foreign investors, Indian equities should do well over the next year. Financials have had a strong year – banks remain well capitalized with a turn up in credit demand. Consumers are still focused on staples, as balance sheets are not yet strong enough for discretionary – but demand for housing is turning up. Technology enabled businesses are in a strong position to capitalize on the tech savviness of India’s young population. Everything from taking out home mortgages, to financing EV car purchases, to paying for everyday expenses can increasingly be done with the indispensable smart phone. Brick and mortar companies have taken note and are partnering with software start-ups to create an ecosystem that can reach both urban and rural areas of the country.

As is often the case when it comes to emerging markets, there are risks. Indeed, one must always bear in mind that Indian equities are still prone to external shocks – oil prices, recession in Western trading partners, food price inflation, and elections next year. Occasionally, the Indian market bears the impact of corporate malfeasance or outright fraud. Consequently, selective stock selection that focuses on companies with exemplary corporate governance standards that prize minority shareholder rights, generate consistent free cashflow, re-invest in their core business, and sparsely rely on leverage is, we believe, the right approach to minimize these risks.