The summer began with a strong rally in US markets. By quarter’s end, that bounce was but a distant memory.

As we enter the final quarter of 2022, investors have again wondered if central banks will stay the course. Signs are accumulating of slowing global growth. Finance officials from around the world shared gloomy assessments of the outlook in October at the annual Washington gathering for the meetings of the World Bank and IMF, where RockCreek took part in the discussions.

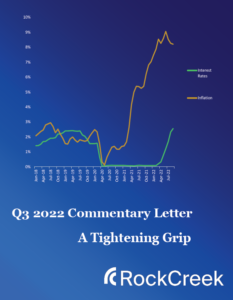

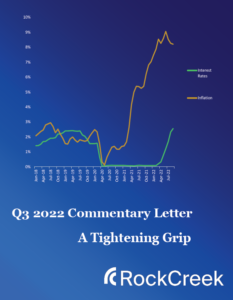

In July, financial markets shrugged off the battering of the first half of 2022, hoping for a pivot to easier money. By September, reality had set in: central banks have a lot more tightening to do. As interest rates marched higher, and the Federal Reserve grew steadily more hawkish, both equities and bonds suffered. By the end of the quarter, the S&P 500 finished down 5%, bringing the overall year-to-date drop to nearly 25%. For US equities, this marked a third consecutive quarterly fall – a first since 2008.

Will this outlook tempt central banks to ease up? Our short answer is no. At RockCreek, we continue to believe the Fed will keep its focus on fighting inflation, waiting for clear evidence – and consensus – that price stability is in sight. Reaching the Fed’s 2% inflation target will take some time and will likely involve economic pain, as Chair Jerome Powell acknowledged in September. He and his colleagues spent Q3 trying to shore up their inflation fighting credentials in both words and actions. They want no doubts about their commitment creeping back into markets.

But while we see more restrictive financial conditions ahead, we expect that debate may build around the pace of tightening. So far, the Fed has moved with record speed to raise rates, breaking with past practice of gradual 25 basis point moves and delivering three consecutive jumps of 75 basis points each from June to September. Speed was appropriate with credibility at stake and a starting monetary stance of considerable ease.

Rapid changes, whether in markets or in life, are hard to manage smoothly. But Chair Powell and colleagues are keen to bring down inflation. But they have no wish to see financial instability.

Against this backdrop, RockCreek sees three themes continuing to play out for the rest of this year:

- Rising global interest rates;

- Synchronized global slowdown;

- Currency complaints, as dollar strength tests other nations’ efforts to curb inflation.

Click here to read the RockCreek Q3 2022 Commentary Letter

Sections

Macro Environment

Sustainable Investing

Public Equities/Emerging Markets

Spotlight: China’s 20th Party Congress

Fixed Income

Public Credit

Private Credit

Private Equity and Venture Capital

Real Estate