A year ago, many — including at RockCreek — looked ahead a whole decade. Of course, what was already circulating unseen — a new virus that triggered a global pandemic at a scale not seen for a century — made those predictions quickly obsolete. Or did it?

Some argue that once the Covid-19 pandemic is behind us, we will go back to a global economy that is not so different from before. This underestimates a shift in economic thinking. Governments and central banks alike are wary of doing too little to support recovery, taking a lesson from the decade of slow growth and increasing inequality that followed the global financial crisis. This has been welcomed by investors, with markets climbing to yet new highs so far in January.

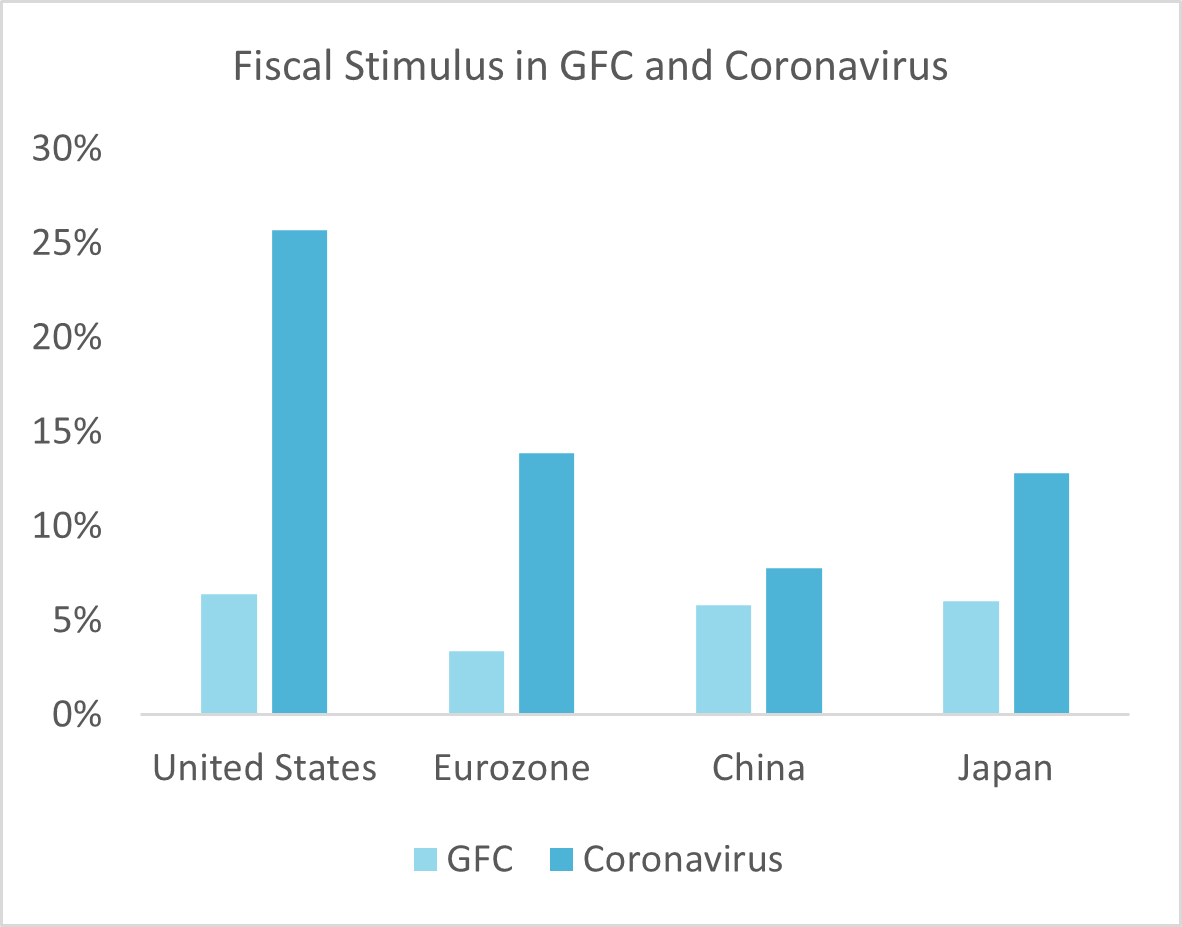

In Europe and Japan, where the Coronavirus Recession has hit hard, governments are planning new fiscal measures in 2021 on top of their actions last year to cushion the pandemic-induced recession. The new US Administration plans to do that, and more. Rapid growth is coming, sooner or later this year, on the back of this fiscal stimulus. Quashing Covid-19 is the first order of business. But President Biden also wants government spending to bring lasting improvement in the lives of working families and vulnerable communities, addressing deep-seated inequality in education, incomes and opportunity. The last-minute 2020 package agreed at the end of Q4 means that $900 billion is already in the pipeline in the US. It will be followed, if President Biden has his way, by another $1.9 trillion in immediate relief and still more to “build back better.” Even if the next package is beaten down in Congress to closer to $1 trillion, as seems likely, these numbers dwarf the fiscal support marshalled after the global financial crisis of 2008/09. And since the Fed promises plenty of notice on trimming bond buying, per Chairman Jay Powell, expect monetary policy to be supportive.

US GFC number in chart above includes $1.9 trillion proposal from Biden-Harris.

So far, no one is talking much about how to pay for all this. The president has bought in to the new thinking that debts and deficits are not so bad, at least for now. At some point, measures to raise taxes — most likely on corporations and the wealthy — will come to the fore. Investors will be on the watch.

For all the talk of a new beginning, Covid-19 has not finished with us yet. Vaccines are here, but the rollout has been painfully slow. A renewed surge of infections, hospitalizations and deaths hit the economy at the end of 2020. Its impact is lingering into 2021. Lockdowns have tightened across Europe and fears of infection from new, more contagious variants have made many more cautious. Once again, advanced economies in Europe and the US have proved less competent than many expected in tackling the latest public health challenge: implementing mass vaccination. The early weeks of mixed messaging and overly detailed guidelines for administering the vaccine likely delayed the return to normalcy. But governments have learned, and the process is speeding up.

Click here to read the full RockCreek Q4 Commentary Letter