Anahita Smeets, RockCreek Vice President, at the SAF Investor Conference

February 27, 2024

RockCreek’s Smart Futures team announced a growth equity investment in Renewance, which is managing and optimizing the batteries at the heart of the energy transition. The team steps in to share their thoughts about the opportunity.

Today, Renewance announced our investment in the company. Renewance maintains, repairs, and otherwise manages industrial batteries in EVs and renewable energy projects. The company’s solutions are not tied to any specific battery technology, meaning Renewance is well positioned to grow as the battery industry continues its meteoric growth. From the moment that we first met Renewance Co-Founder Jamal Burki almost exactly a year ago, we have been incredibly excited about the company. On the heels of that announcement, we wanted to share why.

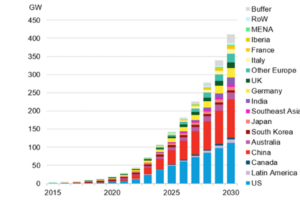

Batteries are a key part of the energy transition and growing rapidly. Electric vehicles and renewable energy are key to the transition and have been given a boost from a combination of increased incentives (e.g., from the Inflation Reduction Act, which specifically provides new incentives for batteries) and improving unit economics. Many energy transition solutions depend on batteries, and battery markets are large and growing rapidly, as seen below:

Global cumulative energy storage between 2015 and 2030

Source: Bloomberg NEF

These are the growth curves that investors love. Those 2030 forecasts are 15x the market in 2021—the “up and to the right” growth curve that investors look for—representing tens of billions of dollars of new investments in batteries per year.

Not so fast though…The challenge, as many investors have learned the hard way, is that the latest and greatest in the battery industry is an ever-evolving thing: each quarter seems to bring new battery chemistries displacing incumbents, with even more efficient, novel technologies on the horizon. Game over, right?

Not quite. We dug deeper. When our Smart Futures team finds a situation like this, we look across supply chains and map the players that touch a battery from raw material through end of life. We noticed a unique trend in this market—many companies focused on battery manufacturing (the “cradle”) and recycling (the “grave”), but there were very few players in the middle. Was there just no need? Time to call the experts…

Managing batteries is a big and growing challenge. Keeping batteries in good working order is of paramount importance to making renewables projects, the power grid, and EVs economically viable. Batteries do in fact need quite a bit of attention once they leave a factory: they travel through complex supply chains, they operate in the field, and things inevitably happen. Battery owners, like renewable project developers and EV fleet owners, need help managing these needs.

Enter: Renewance. We heard about the challenges associated with battery maintenance, repair, refurbishment, re-use, and recycling. The larger the battery, the bigger the problem, leading to extra expenses and headaches. We heard from many players that had no good answers for how to deal with this…and then we heard about Renewance.

A company built to manage industrial batteries by a team that’s been there. Jamal, Sander, and Thomas founded Renewance after finding the challenges described above when they were leading GE’s battery business. They experienced the challenges firsthand, and when they couldn’t find a good solution, they seized the opportunity and formed a company to address the need.

The business has taken off. The Renewance business has grown rapidly. In 2023, it nearly tripled, while also turning a profit. Its customers today include blue chip players across the battery manufacturing and battery ownership space, like Invenergy, Duke Energy, Engie, NextEra, Navistar, UPS, CATL, and others. As the fleet of batteries grows and ages, the need for Renewance’s growing roster of services is accelerating along with it.

This is where Smart Futures comes in. Jamal, Sander, and Thomas impressively have primarily bootstrapped the business to date (our friends at Evergreen Climate Innovations made a small seed investment that helped the Renewance team get off the ground, but they have largely self-financed their growth). They realized that growth capital could help the business scale more rapidly and we saw an opportunity to bring the power of our experience and network to the table.

We found complementary partners. We invested in Renewance alongside IMM Investment, an Asia-based private equity firm with deep relationships with key strategic players in the battery industry throughout Asia and around the world. They are like-minded in how they are thinking about the Renewance opportunity. Chicago-based Evergreen Climate Innovations also invested, bringing their deep Midwest relationships in the climate industry to the table.

In summary… The Renewance investment is prototypical of the type of deals that our Smart Futures team loves. It is a highly innovative business that is both benefiting from and accelerating the energy transition. While the potential impact is huge, the business also has the key fundamentals: great customers, attractive financial profile, significant growth, large and growing market, phenomenal team, ideal investor group…the list goes on and on.

More to come! While Renewance is unique, we find opportunities that share similar characteristics across different markets all the time. Where? Check out our Smart Futures 2024 Outlook to get an idea of areas where we look. Or feel free to reach out to us—we would love to discuss further!

February 27, 2024